2021 deli

Seafood consumers tend to spend more overall at the grocery store and put more expensive items in their shopping baskets.

Chief Editor

By Fred Wilkinson

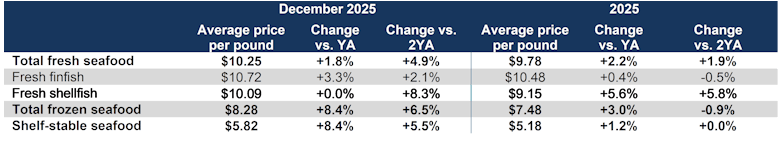

Heading into 2026, prices for finfish and shellfish have been trending higher, averaging more than $10 a pound in December 2025, according to Circana retail sales data analysis. Price inflation for fresh, frozen and shelf-stable seafood picked up in the second half of 2025 after holding mostly throughout 2024 and the first half of the year.

The seafood market heads into 2026 with strong performance for shelf-stable seafood, with increases in dollars, units and pounds. Circana research finds frozen seafood dollar sales up, while volume is down year-over-year. Fresh seafood sales totaled $744 million in December 2025, indicating declines in both dollars and pounds sold. In the full-year view, dollar sales did gain year-over-year, though pounds fell 0.5% behind 2024.

Circana data suggest finfish grew in dollars and pounds sold throughout 2025, while shellfish sales fell in December and in the full-year view. Shellfish pound sales have trended down starting in early 2024, posting average declines of eight to 10 percentage points year-over-year quarterly through 2025.

Source : Circana, Integrated Fresh, Total US, MULO+

Sales data analysis shows salmon tops sales in the fresh/refrigerated seafood category, with salmon posting $4.1 billion in sales for 2025 (representing 47.4% of all fresh/refrigerated seafood sales in December 2025). Salmon produced gains in dollar sales (up 5.8%) and pounds sold (up 2.4%).

Although Circana found that shrimp sales outpaced crab overall in 2025, in December crab sales exceeded shrimp sales ($112 million versus $80 million). Crab sales have been down all year, while shrimp sales were strong early in 2025 but struggled in the second half of the year.

Sustainable seafood

Seafood has long benefited from the “healthy halo” effect thanks to being a lower fat protein as well as a source for healthful omega-3 fatty acids.

Consumers’ embrace of clean-label “smart protein” options positions wild-caught and responsibly harvested seafood to meet these consumer needs.

Wild Alaska seafood outperformed the total seafood category in 2024-25, posting 5.4% volume growth vs. 0.5%. for the total seafood market overall, according to the Alaska Seafood Marketing Institute.

ASMI is a kind of a public -private partnership between the state of Alaska and the Alaska seafood industry (a $6 billion industry), serving as the official marketing organization for Alaska seafood and the Alaska Seafood brand through contributing financial and promotional support for Alaska seafood domestically and around the globe.

According to ASMI, wild Alaska-sourced seafood drives larger retail grocery purchases, with buyers of refrigerated Alaska seafood averaging a spend of $110 per trip (vs. $97 for the category average.

US Food and Drug Administration guidance updates to its “healthy” claim rule, allowing many seafoods (including higher-fat fish like salmon) without added ingredients to automatically qualify due to their nutrient profiles aligns with the recent dietary guidelines update encouraging more protein consumption. The label-claim change became effective in early 2025, with a full compliance date in February 2028.

ASMI Communications Director Greg Smith said consumer trends for clean nutrition, sustainability and transparency in their seafood purchases are shaping the seafood marketplace – and also play to Alaska seafood’s strength.

“Consumers want protein that's clean, trustworthy and climate conscious, and Alaska seafood, which is always wild, checks these boxes,” Smith said. “We have sustainably managed fisheries in our state constitution.”

Alaska has a law that bans the farming of finfish in the state, he said.

“Sustainability is the entire operation in Alaska,” said John Burrows, ASMI seafood technical director. “It's a legal foundation, and it's a major advantage that we have for both buyers and consumers. Sustainability is mandated by law. It's written specifically and explicitly into our state constitution, and that's a driver of quite a few of the state's actions as far as natural resources and especially for fisheries.”

Key Alaska seafood species include king crab, king salmon, halibut and sablefish.

“We know people are prioritizing health and ease,” Smith said. “There's a lot of great diversity and innovation within the Alaska seafood industry to make sure that we can deliver what consumers want. We have a broad number of species that can really hit at all price points. Seafood offers consumers lean, nutrient -dense protein and omega-3s in a variety of product forms,” Smith said, including frozen fillets, or canned or other value -added products like little fish nuggets.”

Smith said frequent purchasers of seafood and wild-caught seafood tend to spend more overall and put more expensive items in their shopping baskets.

“We see a lot of health and wellness driven shoppers,” he said, adding that Alaska seafood also appeals to consumers’ environmental and social values.

Opening photo credit: Getty Images: rudisill