category Report

beef

Photo credit: Eickman's Processing Co.

Beef stays strong

Despite inflationary pressures, consumers are still making purchases in the beef category.

By Sammy Bredar

Associate Editor

As inflation continues to impact the industry, consumers should know what’s trending in the beef category and what to look out for in the future. The American Farmers Network, National Cattlemen’s Beef Association and Eickman’s Processing Co. discuss the current outlook for the beef category, observing present and forthcoming trends for the industry.

The American Farmers Network founder and CEO Sanin Mirvic noted that, despite the inflationary pressures they are facing, consumers are still spending their dollars in the beef category. The AFN is a grass-fed beef company that only works with domestic beef.

Kip Gruell, vice president of sales for the AFN, observed the same point. He noted how consumers are adjusting their dollars to compensate for inflation. “You’ve got a lot of intercategory switching. So if you have those customers that love the beef frank — I’ll use that for an example — moving from a national brand to a private label, because they still want that product,” Gruell said. “So you have some trading down within the category, and then some migration to other categories where there’s more of a value, when you get the pressure like this in beef.”

Merlyn Eickman standing next to smokehouse. Photo credit: Eickman's Processing Co.

Merlyn Eickman on the original processing floor. Photo credit: Eickman's Processing Co.

Processing trends

After the major shifts in the beef industry in the last few years, following the pandemic and the recent inflationary environment, Mirvic said processing has returned to more of a normal state. “This year, we’re more back to normal when it comes to processing beef,” he said.

Gruell noted the rise of sustainable, traceable and certified humane cattle, which he said they already practice in the grass-fed category. Mirvic noted that grass-fed has a variety of benefits consumers are wanting in their products.

On the marketing side, Tom Eickman, president of Eickman’s Processing Co., observed that producers are wanting to be more involved with the marketing of their products. “The direct marketing is definitely a growing trend where the producer wants to be associated with whatever he’s producing,” Eickman said. Eickman’s Processing Co. is a family-owned and -operated business.

Inflationary pressures

Eickman noted that price point has been difficult as live cattle prices have increased.

He observed that beef is running on the high side of price and said to utilize different cuts. Eickman said that ground beef is likely to be where consumers move to save dollars and still be able to eat beef.

Mirvic noted that in this inflationary environment, consumers are adjusting their spending habits and purchasing cheaper products. He observed that, in recent months, ground beef has increased in both retail and foodservice as consumers are opting for those lower-priced products.

Mike Simone, executive director, Market Research and Intelligence, NCBA, a contractor to the Beef Checkoff, supported this sentiment, observing high demand for ground beef.

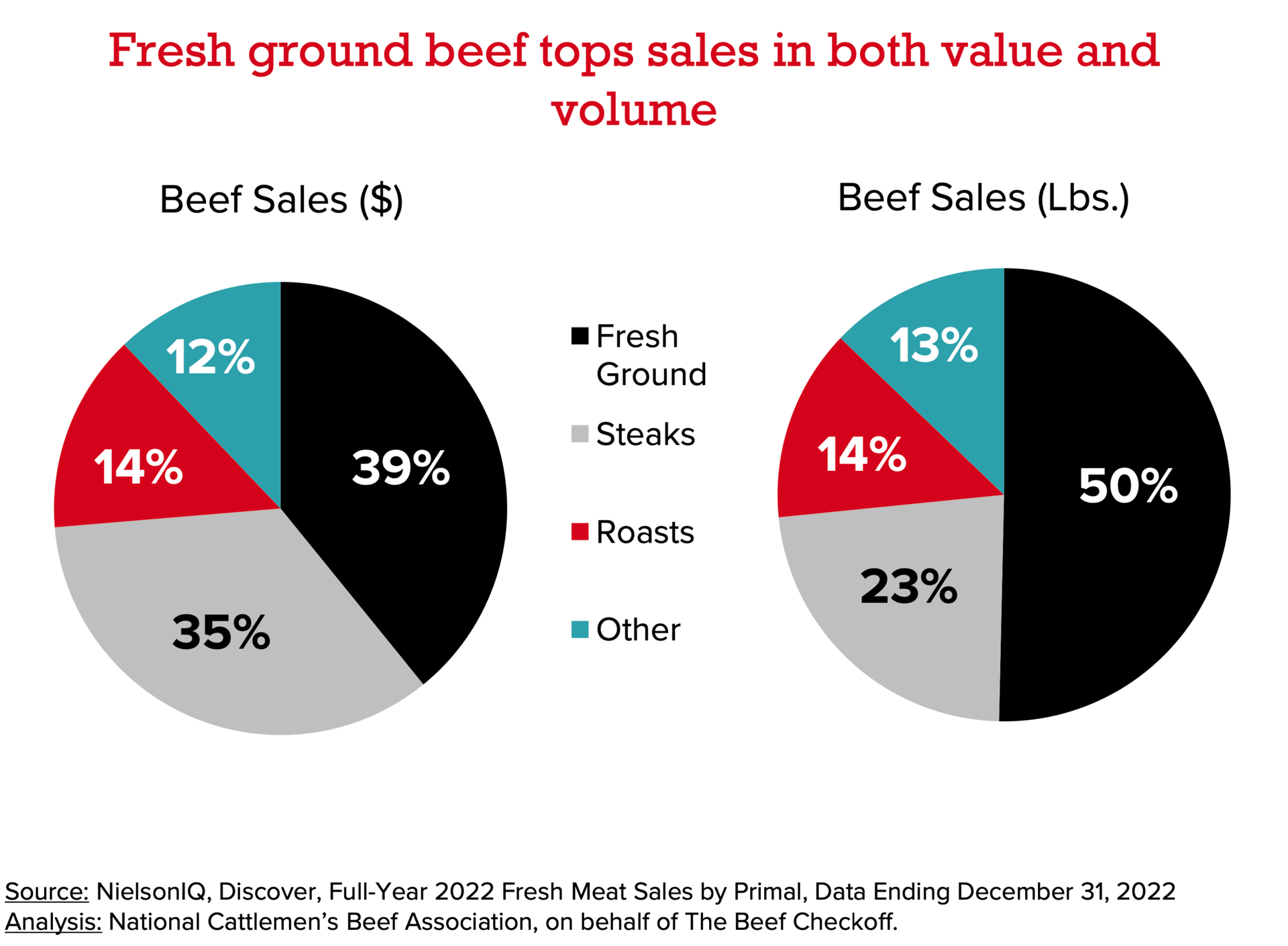

“In 2022 fresh ground beef accounted for 50% of volume of beef sales at retail,” according to NielsonIQ, Discover, Full-Year 2022 Fresh Meat Sales by Primal, Data Ending December 31, 2022.

Due to the higher price point of the product, Mirvic said that the beef jerky category is low.

Gruell said consumers are shifting from jerky products to meat sticks since they are still craving those meat snack products.

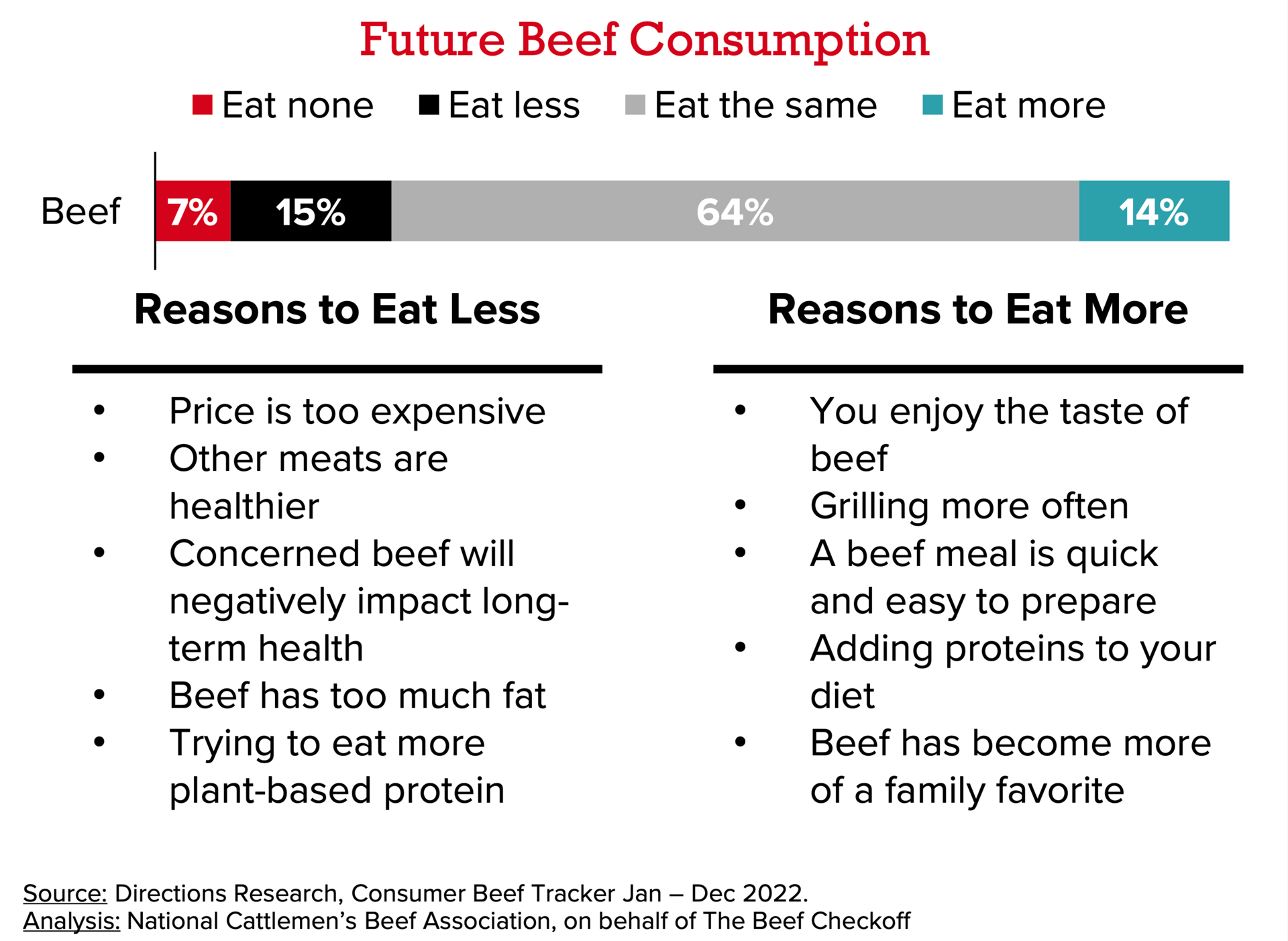

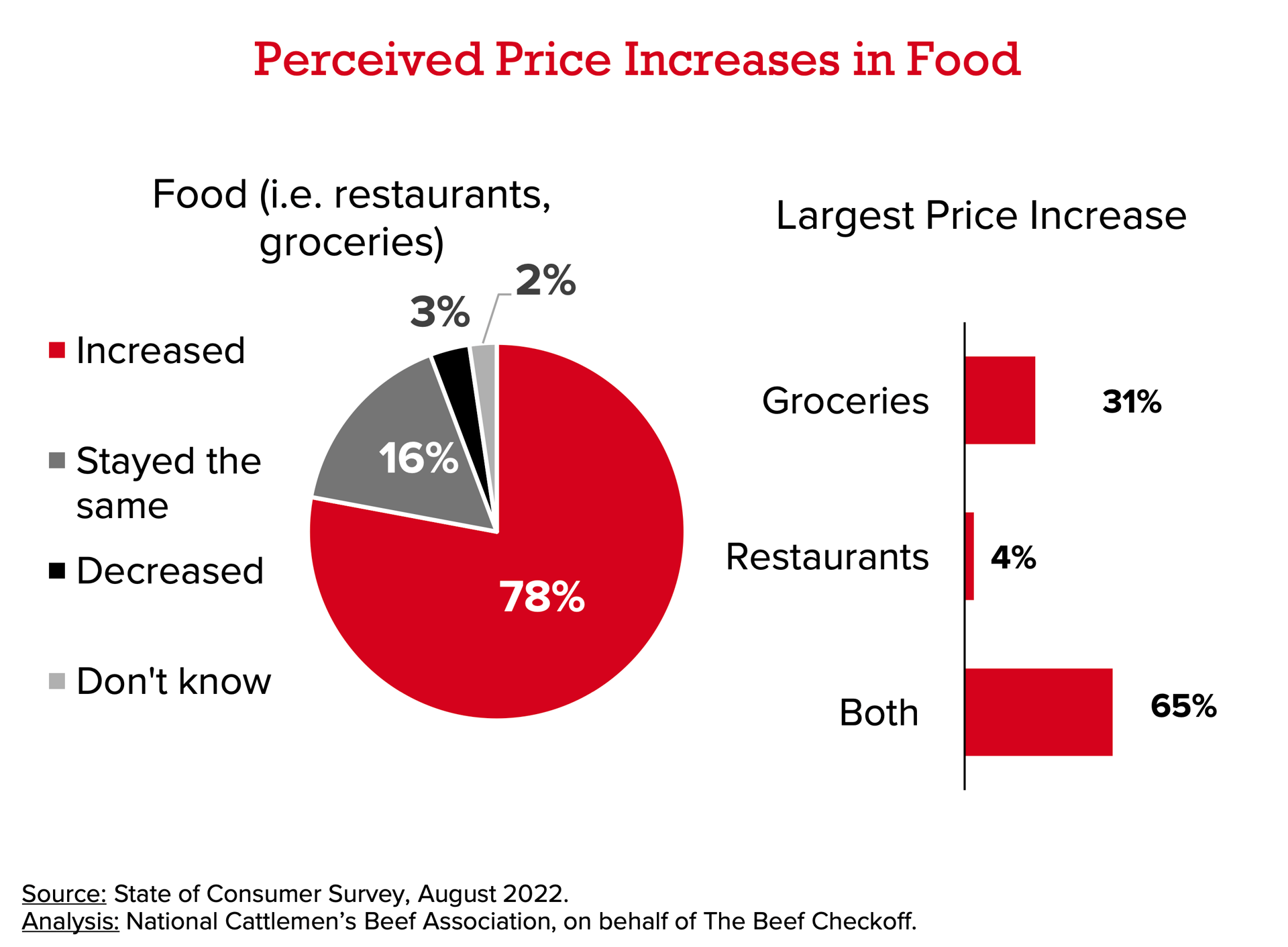

According to the NCBA’s State of the Consumer Survey, August 2022, beef demand in retail and foodservice is anticipated to stay solid.

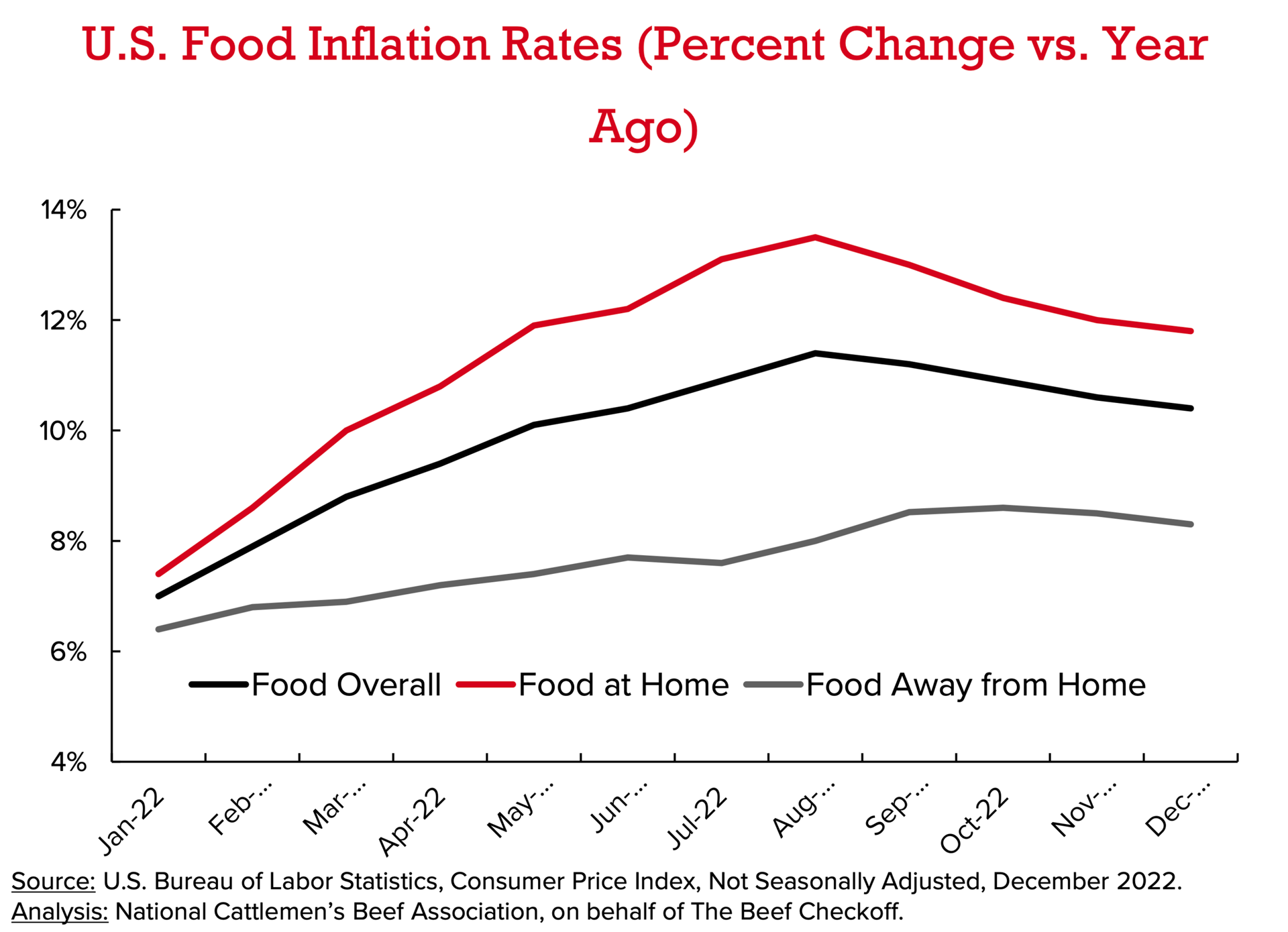

NCBA also reported that inflation has not hit beef quite as hard. “Beef has experienced far lower levels of inflation when compared to other proteins in the Food at Home category,” according to the State of the Consumer Survey, August 2022.

Value-added products

Items like snack sticks are on a growth trajectory, Eickman said. “Anything that can be easily consumed, there’s definitely still growth in that industry,” he said.

Gruell sees growth in value-added products for the grass-fed category, particularly among younger generations.

Mirvic said that the growth for value-added affirms the fact that consumers are shifting their dollars to cheaper products, since value-added products are typically cheaper items.

Popular products

Aside from ground beef, plenty of other beef products seem to be doing well.

Eickman said that they see large demand for bone-in chuck roast and bone-in arm roast during the winter. He also sees that oxtails are very popular for their store. “Ribeye still seems to be king,” Eickman said.

Eickman also is noticing that alternative cuts, like skirt steaks, flank steaks and beef heads, are now selling more in their store.

“While some beef products have experienced a drop in pounds sold, others such as beef brisket, skirt steak, and flank steak have experienced near double-digit percent increases in pounds sold at retail so far during 2023,” according to NielsenIQ, Discover, Retail Beef Sales, 2022 – 2023.

Perhaps one of the most notable findings for the beef category is the rise in consumption of domestic beef products. “More American consumers are consuming domestic beef,” Mirvic said.