2021 deli

cover story: top 100

State of the

Beef Industry 2023

the state

of the

industry

The National Cattlemen’s Beef Association, a contractor to the Beef Checkoff, provides market analysis and data.

By Mike Simone and Elizabeth Smith

The past year has painted a mixed picture from an economic and consumer perspective. Consumer markets and behaviors have begun to normalize after the pandemic. However, inflation remains a formidable financial consideration for consumers. Looking forward, consumer sentiment is improving, but economic headwinds warrant a close eye as beef prices are on the rise.

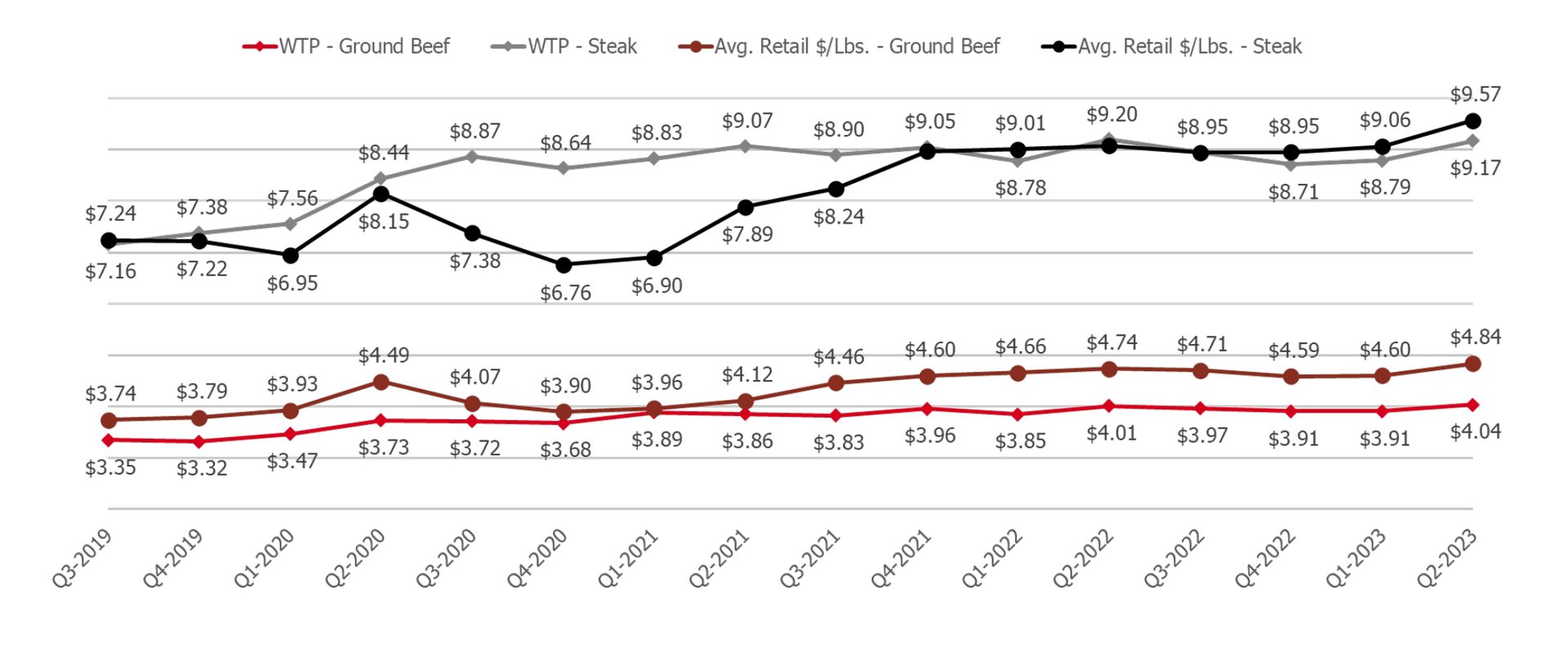

Figure 1: Consumer-Reported Willingness to Pay for Retail Beef vs. Average Retail Price

Source: Consumer Beef Tracker 2019-2023. NielsenIQ, Discover, Average Price Per Pound for Select Proteins, 2019-2023.

Analysis provided by National Cattlemen’s Beef Association, a contractor to the Beef Checkoff

Beef prices and demand

As of July 2023, overall inflation was 3.2% (12-month percent change), with retail prices, foodservice prices, housing prices, and core inflation all experiencing year-over-year increases, according to the U.S. Bureau of Labor Statistics, Consumer Price Index, Retrieved Aug. 15, 2023.

Along with record mortgage rates and other increasing expenses, this contributes to an elevated cost of living, which inevitably has consumers taking a closer look at their spending patterns and how much they are willing to pay for essentials like food and housing in addition to “nonessential” items such as apparel, entertainment/leisure/travel and dining out.

In 2022, beef prices experienced lower rates of increase compared to other food categories and were actually in negative territory for several months, according to NielsenIQ, Discover Platform. Retrieved Aug. 15, 2023. The same data shows that from June 2022 – June 2023, however, beef prices were up 5.8%, outpacing overall inflation and price changes for other proteins like chicken and pork.

Despite these increases, consumer willingness to pay for beef is remaining close to the average prices actually paid for ground beef and steak seen in the retail setting, as is shown above. This demonstrates that consumers remain willing to adjust the amount they spend to eat beef, particularly when it comes to steak. At the same time, some movement to chicken is also noted in the sales data, while pork is down slightly (but could change if pork pricing advantage moves more consumers). How much consumers are willing to flex their budgets to buy beef moving forward will likely be influenced by factors including if incomes keep pace with inflation, the cost of other groceries and proteins, and how much beef prices continue to increase.

Retail and foodservice

Across the food sector, retail prices (+3.6%) and foodservice prices (+7.1%) have both experienced year-over-year increases, as of July 2023. This is according to NielsenIQ, Discover Platform. Consumers are noticing this, as 57% say they have spent more on groceries in the past six months, while 24% report spending more on dining out, according to the State of the Consumer survey. 2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff. The same data shows that, to combat inflationary increases, 47% say they will dine out less, while 46% anticipate looking for deals or coupons more often, and 37% say they plan to stock up or freeze items more often and find more ways to use leftovers.

For beef, the combination of increased price per pound and consumer reaction to inflation has resulted in a 0.8% decrease in pounds sold at retail in the first six months of 2023 compared to 2022, according to NielsenIQ, Discover Platform. So far, this decrease has largely been counterbalanced by the increased price per pound of beef at retail.

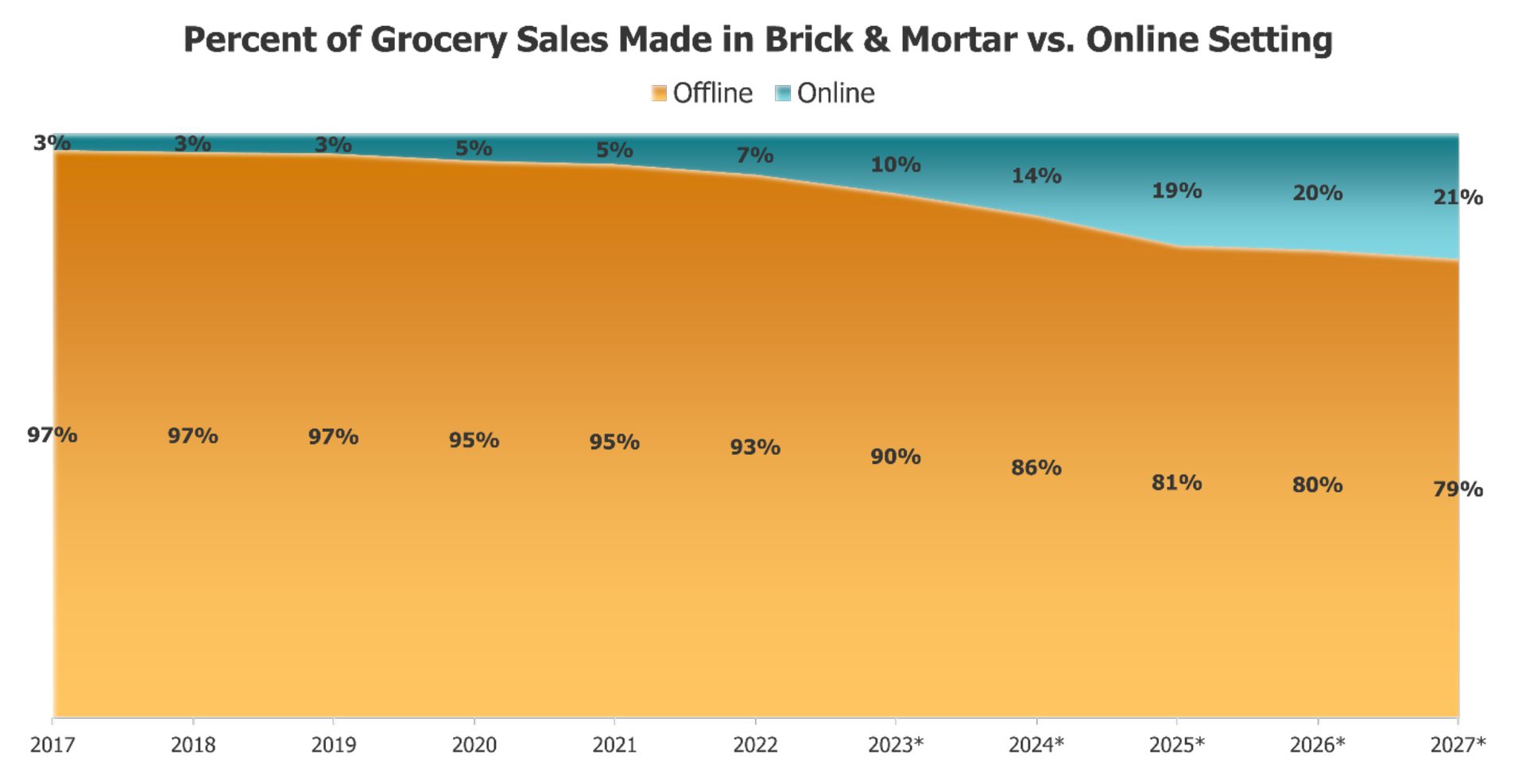

Figure 2: Historic and Projected Grocery Sales. * = projection

Source: Statista Market Insights, July 2023

Analysis provided by National Cattlemen’s Beef Association, a contractor to the Beef Checkoff

E-commerce

As shown in the figure above, online sales are an area of opportunity and projected growth for grocery sales as a whole. After limited change from 2017–2019, e-commerce for groceries shopping saw an increase during the pandemic. This is predicted to slow but continue a gradual upward trajectory into 2027. Consumers report that 57% are actively ordering groceries online (down from 64% in 2022), with pickup and delivery being the most popular methods, according to the State of the Consumer survey. 2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff. The same data shows convenience, ease of purchase, and time savings are the top cited reasons why consumers choose to participate in e-commerce grocery shopping.

Most are selecting shelf-stable goods in their online purchases. However, 43% of online grocery shoppers say they have ordered fresh beef online in the past month. Of those consumers, 57% purchased ground beef, 23% purchased steak, and 16% purchased a beef roast. Consumer satisfaction with these beef purchases was high, with 89% reporting they were satisfied with their ground beef purchase. Eighty-four percent were satisfied with their steak, and 80% were satisfied with their beef roast purchase. This is all according to the State of the Consumer survey. 2023.

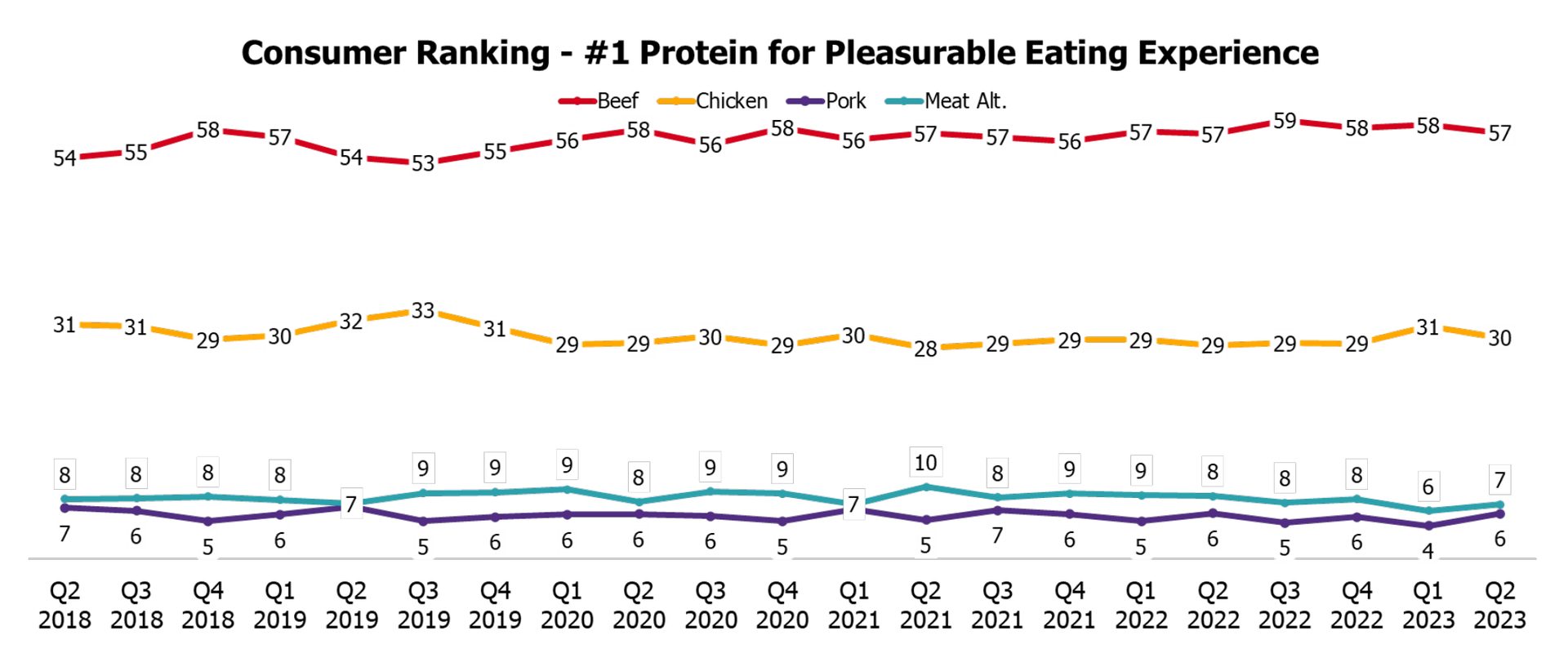

Figure 3: Pleasurable Eating Experience

Source: Consumer Beef Tracker, 2021-2023.

Analysis provided by National Cattlemen’s Beef Association, a contractor to the Beef Checkoff

Beef satisfaction

As shown in the figure above, beef is consistently ranked first for pleasurable eating experience, compared to other proteins. In part, eating experience is comprised of tenderness, flavor and juiciness. Thanks to collective efforts across the beef industry, steaks have increased in tenderness and consistency in recent years, with over 82% of beef graded USDA Choice or Prime thus far in 2023, according to Consumer Beef Tracker. 2018-2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff.

Beef also outranks other proteins in consumers’ perception of being a great source of protein and being great tasting, among other metrics, according to the National Beef Tenderness Survey. June 2022. These are key metrics to monitor, as considerations like taste and eating experience, nutrition, and convenience and versatility are key drivers of beef demand, according to Demand Drivers Report Jan 1, 2022 – Dec 31, 2022. Independent analysis of self-reported consumer data.

Meat alternatives

Additionally, consumer enthusiasm for animal proteins remains high compared to meat or plant-based alternatives. In the first six months of 2023, meat alternatives represented just 0.2% of total fresh protein sales, and beef substitutes were just 0.4% of the value of fresh beef, according to NielsenIQ, Discover Platform. Further, the total retail sales value of meat alternatives was down over 30% through the first six months of 2023.

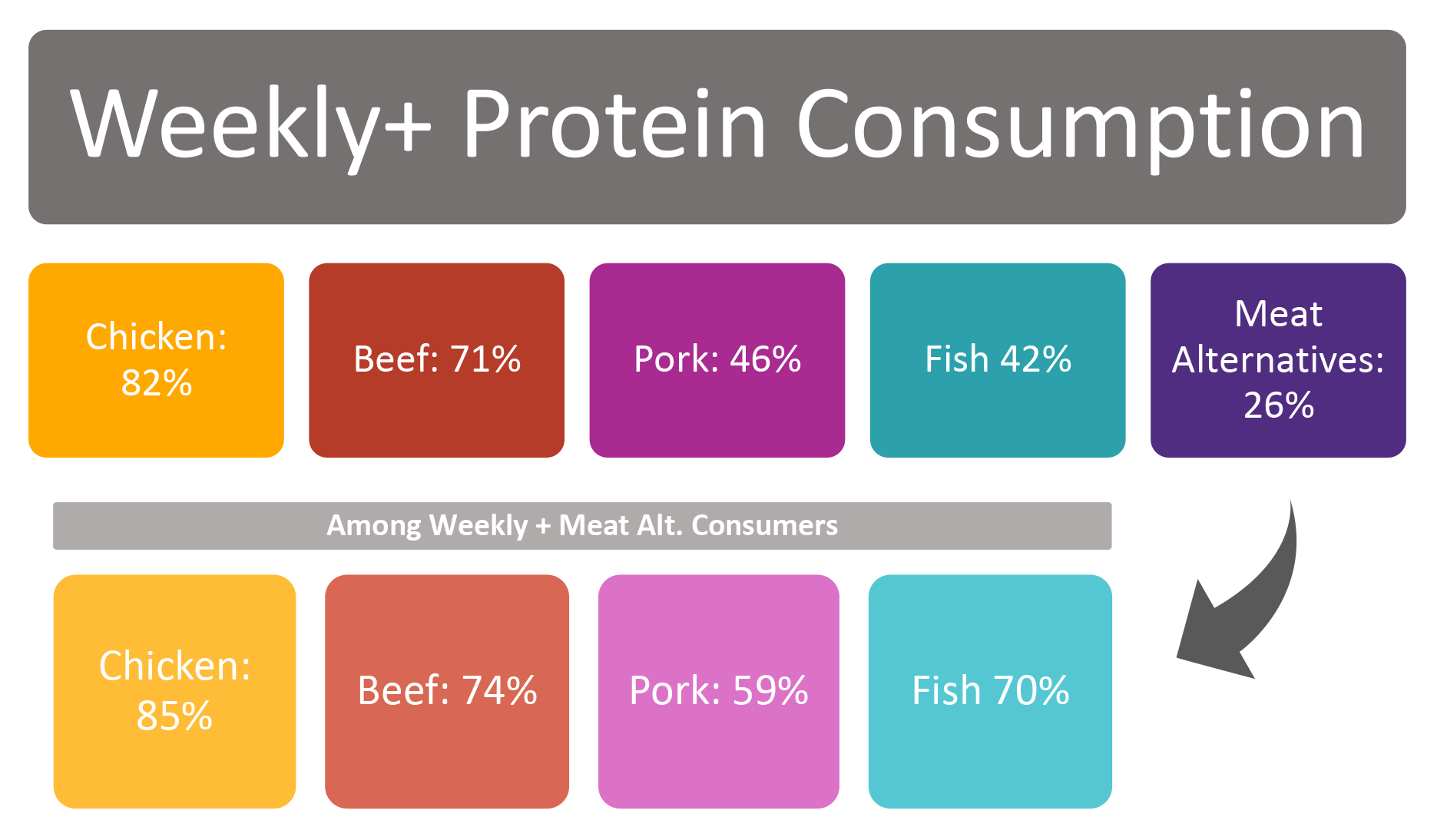

Figure 4: Weekly+ Protein Consumption

Source: Consumer Beef Tracker, January – June 2023.

Analysis provided by National Cattlemen’s Beef Association, a contractor to the Beef Checkoff

Twenty-six percent of consumers report eating meat alternatives at least weekly, down from a peak of 34% in 3rd quarter 2020, and even the heaviest meat alternative consumers are not moving away from animal proteins completely, according to Consumer Beef Tracker. 2018-2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff. In fact, consumers who choose meat alternatives at least weekly are more likely to eat beef, chicken, pork and fish than the general population of meat consumers.

Conclusion

All things considered, the demand for beef remains in a strong position, with some challenges ahead. Inflation and a higher cost of living in combination with rising beef prices have consumers particularly mindful of their pocketbooks. Yet beef has unique traits that consumers find desirable and encourage them to continue choosing it over other proteins. Looking forward, expect consumers to place increasing emphasis on their budgetary considerations when choosing what to eat.

Mike Simone is executive director, market research & intelligence, for National Cattlemen’s Beef Association, and Elizabeth Smith is associate director, market research, for NCBA.

Sources:

- U.S. Bureau of Labor Statistics, Consumer Price Index, Retrieved August 15, 2023.

- NielsenIQ, Discover Platform. Retrieved August 15, 2023.

- State of the Consumer survey. 2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff

- Consumer Beef Tracker. 2018-2023. Survey fielded by National Cattlemen’s Beef Association on behalf of the Beef Checkoff.

- National Beef Tenderness Survey. A.A. Gonzalez, E.P. Williams, T.E. Schwartz. A.N. Arnold, D.B. Griffin, R.K. Miller, K.B. Gehring, J.W. Savell. Department of Animal Science, Texas A&M University. June 2022.

- Demand Drivers Report Jan 1, 2022 – Dec 31, 2022; N=7,752 compared to Jan 1, 2021 – Dec 31, 2021; N = 6,003. Independent analysis of self-reported consumer data, commissioned by the National Cattlemen’s Beef Association, a contractor to the Beef Checkoff

- Agricultural Marketing Service, United States Department of Agriculture, Year to Date, August 2023.

Opening image credit: GettyImages / nickalbi / iStock / Getty Images Plus