Sausage Report

2024

Seaboard Foods

2024 Processor of the Year

cover story: 2024 MIHOF

Today’s beef consumer

seeks value and convenience

BEEF

Growth is expected in the food e-commerce sector in the coming years, reflecting consumer preferences for convenience

By David Friedlander National Cattlemen’s Beef Association

At-a-glance

- Economic uncertainty is reshaping consumer behaviors, prompting consumers to prioritize affordability and value.

- Consumers are adjusting their spending habits and finding ways to stretch their dollars.

- Despite tighter supply and higher prices, beef demand remains robust, as indicated by consumer-reported consumption and retail sales data.

- Within the beef category, consumers may trade down, opting for more affordable options like ground beef.

- Younger generations are leading the way for food e-commerce, which expects steady growth.

Although consumers are feeling slightly better about the economy, inflation and tariff concerns continue to shape consumers’ decisions and behaviors. Consumers are optimizing their spending and seeking value in their purchases. The National Cattlemen’s Beef Association (NCBA), a contractor to the Beef Checkoff, continuously tracks trends, monitors issues and stays abreast of the trends that have potential to impact the beef industry to better understand Today’s Beef Consumer.

The consumer landscape

Inflation (43%) and tariff policies (29%) rank as the top two concerns for US consumers, according to McKinsey & Company.1 These persistent economic headwinds are contributing to consumers’ uncertainty about the future. The University of Michigan’s Consumer Sentiment Index rose 2% in July 2025, tracking at 61.7.2 While consumer sentiment for July continues to see month-to-month growth, there is still a notable decline of nearly 7% compared to year-ago levels.2

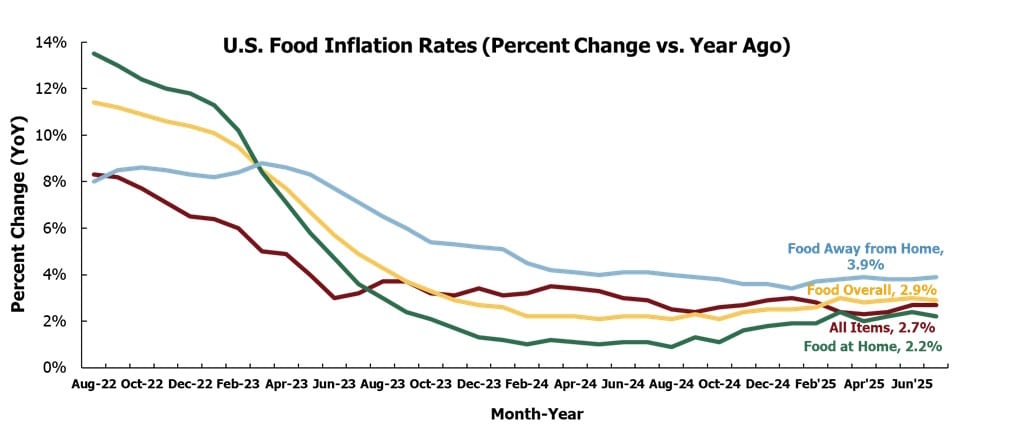

Credit: US Bureau of Labor Statistics

Although inflationary pressures continue to show signs of easing, food prices have outpaced overall inflation since March 2025. The July 2025 Consumer Price Index for all items rose 2.7% from year-ago levels and is up 0.2% from June 2025. Overall food costs ticked down in July 2.9% from year-ago levels. Food at home showed a modest decline from June levels, in spite of higher inflationary pressures driven by meats, poultry, fish and eggs, up just over 5.2% year-over-year, while food away from home ticked up slightly versus year ago levels. An encouraging note, there are year-over-year declines for categories including energy and gasoline.3

Protein consumption and sales trends

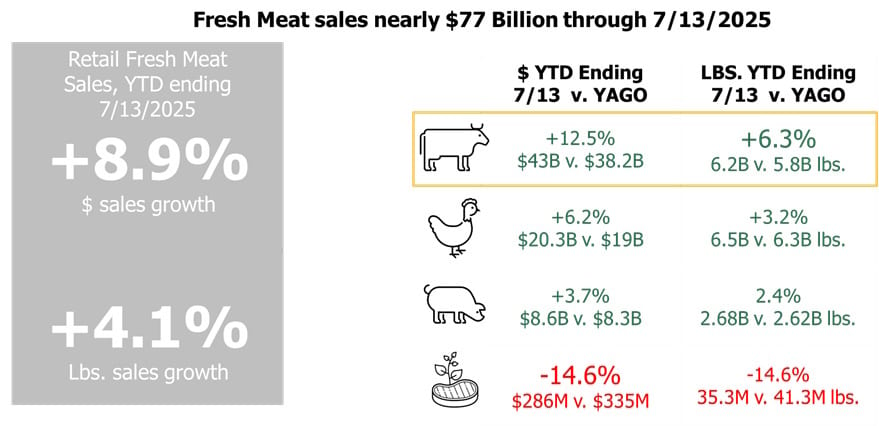

Year-to-date retail beef prices through July 13, 2025, averaged $6.94/lb., up 5.8% from a year ago. Over the same period, retail chicken prices increased by 2.9%, and pork prices rose 1.2%.4 However, the price per pound that consumers indicate they are willing to pay for ground beef and steak is not keeping pace with average retail prices.5

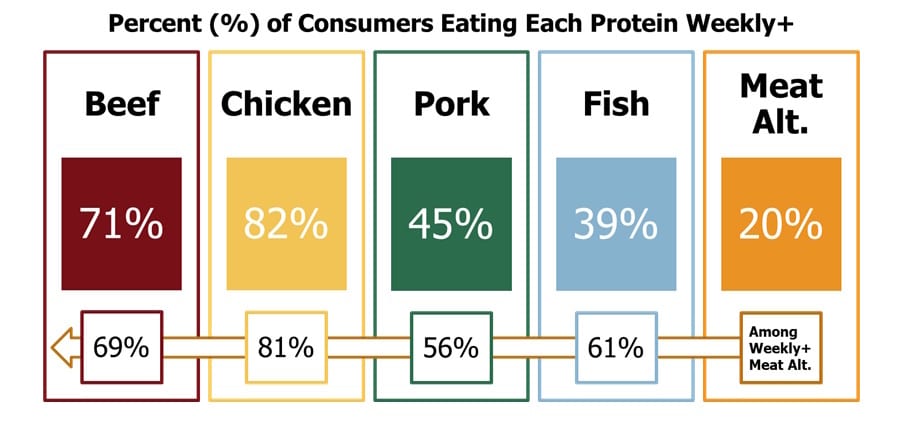

Despite tighter supply and elevated retail prices, consumer demand for beef remains robust, as indicated by consumer-reported consumption and retail sales data. A large majority of consumers eat beef (71%) and chicken (82%) at least once per week.5 Looking ahead, more than 80% of consumers plan to maintain or increase their beef consumption, driven primarily by taste and nutritional value. Though, concerns about price and health are reasons some may eat less.5 While chicken is historically perceived to be first in terms of value for money, beef leads in taste, convenience and versatility, driving its demand and influencing consumption and preference.5

Credit: Consumer Beef Tracker

Credit: Circana

Other proteins are experiencing mixed gains. Dollars and pounds sold for chicken and pork are both up, while meat alternatives continue to see double-digit declines in both areas.4 Weekly consumption of meat alternatives is also down 11 percentage points since 2021.5 Those who regularly consume meat alternatives also tend to consume higher quantities of beef and other animal proteins.5 This trend suggests that meat alternatives are often used to complement, rather than replace, traditional meat.

Prioritizing value

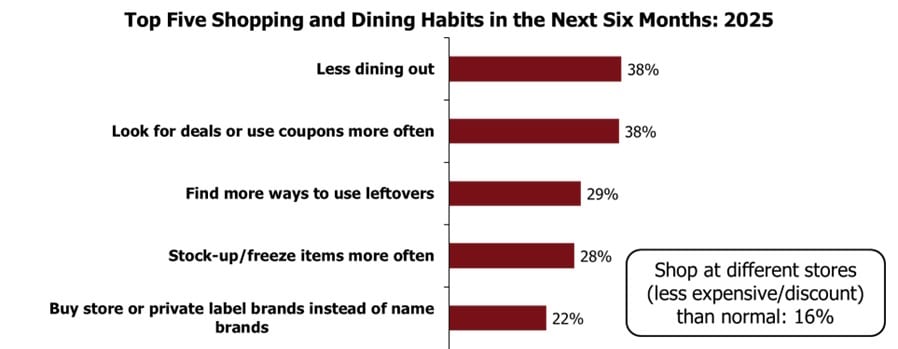

Faced with persistent inflation and higher food costs, consumers are becoming more deliberate about where and how they spend their money on food. Dining out has become more occasional, with consumers enjoying more home-cooked meals to better manage their budgets. In fact, about 34% of consumers are reportedly having more meals at home and plan to continue this trend.5

In addition, consumers are cutting back on non-essentials and using various cost-saving strategies to maximize their purchases. More than one-third of consumers actively seek deals, while over 25% are finding ways to use leftovers and stock up or freeze items more often.5 About 22% of consumers are opting for private-label items, drawn by their value and comparable quality to name brands.5 Private labels have notably gained traction in recent years. Private Label Manufacturers Association (PLMA) reports that in the first half of 2025, private-label dollar sales were up 4.4% from a year ago, compared to a 1.1% gain for national brands. In addition, private labels outpaced their name brand counterparts in unit sales, with a 0.4% increase and a 0.6% decrease, respectively.6

Credit: Consumer Beef Tracker

Protein remains an essential part of the diet, though consumers are navigating the meat aisle with a more budget-conscious mindset. Consumers are gravitating toward meats that balance taste and value. More affordable proteins like chicken, ground beef, and fish are taking precedence over premium options like steak.5 Cargill reports that over half of shoppers have reduced the amount of meat purchased due to high prices, and nearly one-third are opting for cheaper cuts, different protein choices or smaller portions.7

Beef’s versatility allows budget-conscious shoppers to select cuts or types that align with their budgets. Consumers are trading down within the category, favoring ground beef for its lower price point, convenience and versatility.5 They frequently use it at home as an ingredient or for burgers.5 Yet, many consumers still want to replicate dining out experiences at home — 46% of consumers consider the cut or type of meat as a critical factor when shopping for animal proteins, often favoring premium options, like steak, to replicate dining out experiences, reported by Cargill.7

Food e-commerce

Online meal delivery and grocery shopping services continue to be popular, primarily for their convenience, time-saving benefits, and ease of use.5 Many consumers turn to these services monthly, with approximately three-quarters actively ordering meals and over half ordering groceries.5

The online food delivery market is experiencing significant growth, with revenue projected to reach $430.85 billion in 2025 and expected to grow at a CAGR of 6.9% to $602.78 by 2030. In particular, the grocery segment is a large part of the equation, with a projected market volume of $327.72 billion in 2025.8

While brick-and-mortar stores remain the primary shopping destination across all age groups, the younger demographic is leading the use of online grocery shopping.9 In fact, about two-thirds of consumers under the age of 45 do at least some of their shopping online, which intensifies the younger the shopper is.9

Credit: Appinio

Within the online grocery retail channel, shopping carts frequently contain non-perishable, packaged goods and dairy products. In addition, fresh proteins are included by 23% to 43% of online shoppers. More specifically, 39% of online shoppers included fresh beef in their carts recently, and most were satisfied with their purchase.5

Conclusion

Economic uncertainty has prompted many to rethink their spending habits, prioritizing affordability and value. In response, consumers are making budget-conscious and value-driven decisions, seeking deals and trading down to lower-cost alternatives. Additionally, significant growth is expected in the food e-commerce sector in the coming years, reflecting consumer preferences for convenience.

David Friedlander is senior director, market research, for National Cattlemen’s Beef Association.

Sources

- McKinsey ConsumerWise Global Sentiment Survey, Apr-May 2025.

- The University of Michigan, Consumer Sentiment Index, July 2025.

- U.S. Bureau of Labor Statistics, Consumer Price Index, Not Seasonally Adjusted, August 2025 Release.

- Circana, Fresh Beef Sales by Volume and Value, Data Ending 7/13/2025.

- Consumer Beef Tracker, January – June 2025.

- Private Label Manufacturers Association, PLMA e-scanner, July 12, 2025.

- Cargill, Protein Trends Report, 2025.

- Statista, Market Insights, Online Food Delivery, 2025.

- Appinio, “Where Consumers Usually Purchase Groceries in the United States in June 2023, by Age Group.” Statista, Statista Inc., August 2023.

Opening photo credit: Getty Images / shaunl / Getty Images Plus