Sausage Report

2024

Seaboard Foods

2024 Processor of the Year

cover story: 2024 MIHOF

Meat and poultry industry

navigates uncertainty

OVERVIEW

From the tight beef supply to looming tariff costs, businesses and consumers remain wary of market conditions.

By Dan Emery Meaningful Solutions

One of the central strategies of the Trump Administration is creating chaos to deliver an agenda that is clouded by many other issues. This will create a challenging environment to run our businesses. If you understand what is really happening, you can prosper when others fail. It is difficult to invest when you do not understand the rules. Immigration enforcement is meant to scare people who are illegally here back across the border, creating a labor shortage of entry-level workers.

Beef supply is very tight, while the broiler supply has grown moderately to match domestic demand, and pork supply has grown moderately in 2025. Feed ingredients will be very affordable, helping producers control costs. Many producers have been struggling to make a profit but are making progress moving back into the black.

Broiler production was forecast to be higher for 2025, according to the July World Agricultural Supply and Demand Estimates report, issued by the US Department of Agriculture. Broiler production was raised for the second and third quarters based on higher weights. The estimated pounds will increase to almost 47.7 billion pounds to be produced versus 2024. Broiler export estimates were reduced for 2025 due to trade wars and international competition in key markets. No changes were made for export forecasts for turkey production in 2025 or 2026.

The report noted that turkey production was lowered primarily due to recent production and hatchery data. Turkey production on an annual basis was estimated at 4,796 million pounds, down 2% from 2024.

Egg production was also lowered in the recent hatchery data. The total egg production is now estimated to be 4.6% lower than in 2024. Both turkey and egg production were impacted earlier in the year by bird flu but have stabilized and are beginning to rebuild their supply chain.

Total commercial pork production in 2025 is forecast at 28 billion pounds, 0.9% higher than in 2024, and in 2026, is forecast at 28.5 billion pounds, 1.6% greater than this year.

Based on recent data in milk cow inventory, dairy cow slaughter and expectations of favorable margins in the near-term, the forecasts for the average number of dairy cows, milk per cow and total milk production have all been revised upward for this year and 2026.

Outlook for the ongoing tight beef market

Beef prices soar beyond other proteins. Feeder cattle prices continue to push to new highs, leaving producers and traders increasingly nervous. Price increases are especially pronounced compared with other animal proteins. Fresh pork prices are up just 1.8% from last year, with boneless pork chops nearly flat at 0.8%. Fresh chicken, meanwhile, is up 2.9%, with whole chickens up 4.5% and boneless breasts up 6.5%. * Year-over-year in July, the average price for fresh beef was up 9.2% to $8.90 per pound. For choice, the price was even higher at $9.69 per pound, a 14.9% increase. Meanwhile, ground beef rose 13.8% to $6.25. The 2025 US calf crop is the lowest since 1941.

The beef cow herd is at a cyclical, and multidecade low and is showing little sign of rebuilding. With no significant heifer retention, the implication is that tight feeder supplies must get tighter yet to begin the process that will lead to eventual herd rebuilding. Herd rebuilding is slow to start and appears to be slow. This suggests cattle prices will move higher and remain elevated for an extended period, with a peak that is still in the future. Record prices, profits and losses are the story of the US cattle and beef industry in 2025.

The closure of the Mexican border added to the ever-tighter feeder cattle supply. The slow decrease in feedlot inventories in the last two years has masked the fact that feeder supplies are continuing to decline. The feeder cattle supply is an increasingly hollow supply that will implode at some point. Current feeder cattle markets reflect that evolving process.

Market volatility is further stressed by the uncertainty of tariffs and their impact on US beef trade. At the same time, there is additional uncertainty in a structurally changing industry. What this means to the supply chain going forward is not totally known or perhaps even perceived by many, but change is happening. With or without tariffs, the US beef industry is defined by the supply-demand across the entire supply chain. It will be increasingly important to manage capacity. The old pricing models that we have known for decades are outdated as the industry aligns pricing from retail/foodservice to packer to producer. Market analysis has become much more than assessing cattle on feed numbers.

Beef packer margins improved but remain in the red, as the comprehensive beef cutout climbed, with packers posting losses averaging $209.63 per head. The capacity and utilization of capacity are crucial factors impacting margins. During late July through Aug. 2, 2025, plants operated at 77% utilization and cow plants at 60%, and beef packers saw their average margin fall to a record low, according to estimates beginning in January 1988.

We are in the middle of a major demographic shift in the US. Seventy percent of the Baby Boomers, a large group, are retired or of retirement age, which dramatically changes the way they act. Their investments are in a lower-risk item; their spending is lower; food purchases are lower; and many are no longer in the workforce. In the US, we have a 12-year gap where we have a dramatic reduction in working-age adults. This means we will have a labor shortage during that period. We are in the first part of that phase.

Foodservice reservations

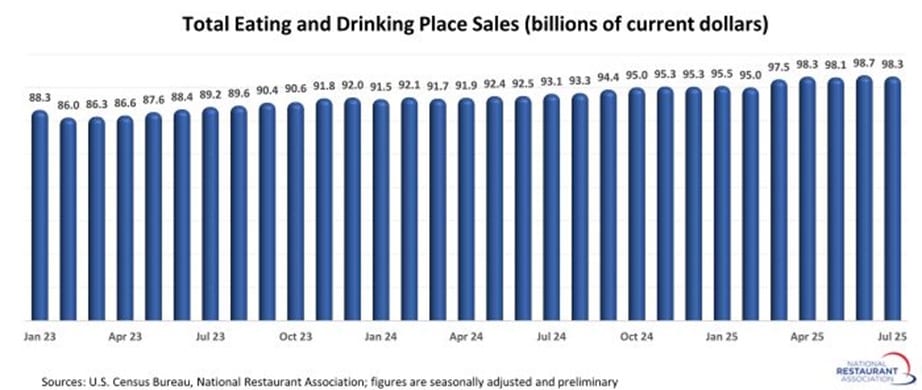

Restaurant sales and traffic slowed in 2024, and for some individual chains, those negative trends have continued into 2025.

Sales among the nation’s 500 largest restaurant chains increased 3.1% in 2024, but that was the lowest annual increase in 10 years – excluding the COVID-19-related slowdown in 2020 – according to Technomic’s 2025 Top 500 Chain Restaurant Report.

The report also found that 40% of US restaurants experienced a sales decline last year.

"The restaurant industry faced significant headwinds in 2024, including higher prices, shifting consumer spending patterns, and increased competition," Technomic Senior Director of Industry Research Kevin Schimpf said. "Despite a challenging environment, top 500 chain sales stayed positive, climbing for the fourth consecutive year.”

Despite the recent slowdown, the expectation is that the economic expansion will remain intact. This will give consumers the financial wherewithal to continue spending in restaurants.

On an inflation-adjusted basis, eating and drinking place sales stood 1.6% above their year-ago levels in July, which means nominal sales outstripped growth in menu prices during that period.

However, a more recent timeframe reveals a gradual downturn in real restaurant sales. On an inflation-adjusted basis, eating and drinking place sales in July were down 0.9% from their recent peak in April 2025.

Tariffs’ effect on US meat/poultry imports /exports: Global wildcards

Tariff negotiations will be ongoing with many countries. US agricultural products, popular export items, are typically singled out in reprisals during trade wars, causing problems for items that are critical to the US meat industry.

China is a major wild card. China has artificially inflated its GDP, which has created a massive oversupply in the car business, shipbuilding, real estate, and other manufacturing sectors. Part of the Trump Administration's strategy is to isolate China. The effects of the Trump administration’s tariffs on imported and exported goods are starting to show up on the bottom lines of US food companies, but industry experts say there are tariff strategies that can be implemented now to help reduce financial impacts and position companies to be nimble and resilient in the long term.

“For starters, transparency is key during this ongoing trade war,” said Kelly Beaton, chief content officer, The Food Institute, speaking at the recent IFT FIRST conference in Chicago. “Research by the Collage Group found that many companies have avoided detailing and explaining tariff-related impacts in their consumer messaging. That’s a mistake. The better strategy moving forward is building trust through transparent updates, explaining how decisions are made, like why a recipe changed or why a price rose.”

The US has also criticized the EU bans on importing US poultry that has been cleaned in chlorine. Chlorinated chicken is banned in Europe.

Consumer sentiment plummeted as news of the tariffs spread.

Every quarter, ConsumerWise research. Asks US consumers how they feel about the economy and how those sentiments might influence their spending. Earlier this spring, following announcements that global trade tariffs could be imposed, both markets and consumers reacted sharply.

They conducted a targeted survey in May to understand how tariffs are shaping consumer concerns and behaviours. What we found was that net sentiment1 dropped 32% in May 2025, a nine-percentage-point swing from the previous quarter. While inflation remains consumers’ top concern, tariffs have quickly risen to second place.

Despite news of tentative trade deals, uncertainty and volatility persist in the US market, and consumers may explore a range of personal financial behaviours to protect their pocketbooks. In the US, 43% of consumers reported rising prices as their top concern, followed by tariff policies (29%). This comes as little surprise, given how much the discussions of global trade have occupied the American media and how engaged US consumers have been with tariff-related news (91% of consumers in the US have heard about tariffs in the news or discussed the topic with others).

Most consumers surveyed said they either have already changed their spending habits or expect to change them soon in response to tariff announcements — even if the tariffs’ effects have yet to hit store shelves. However, consumer responses varied by generation: Gen Z and Millennials were more likely to say they expect to change their spending habits, while baby boomers appeared more resistant to change. One reason for these findings could be that US boomers in our previous surveys were already the least likely to splurge, meaning there could be less impetus for them to change their spending habits in response to greater economic uncertainty.

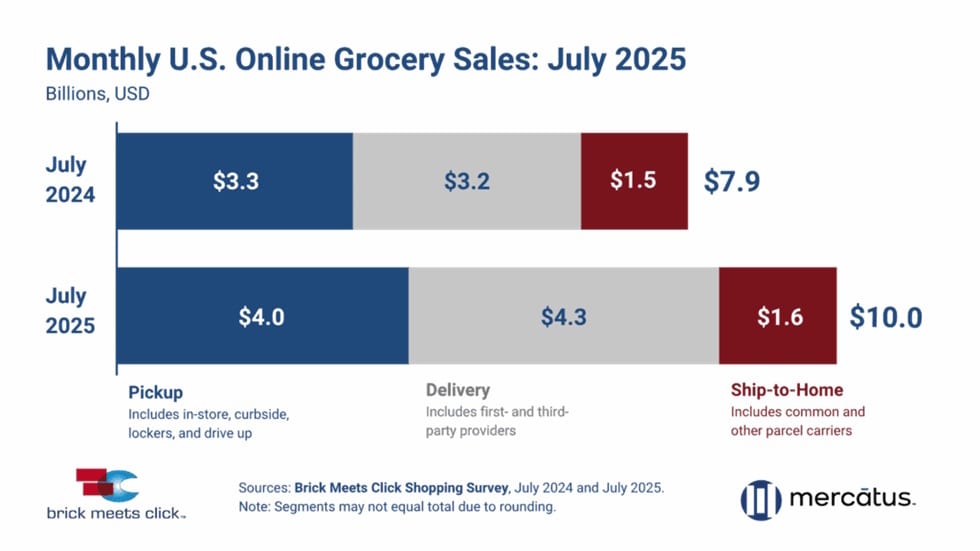

July 2025 online grocery sales grow more than 25% year over year.

Summary

Consumers are clearly impacted by inflation; they've changed their purchasing habits by trading down to more private labels and generics products, they're eating out less and eating at home more. Conversely, online grocery purchases continue to grow at a robust rate. Clearly, consumers wanted to get ahead of Trump's tariffs, so they hoarded certain items such as cars and other imported items. This caused a seesawing effect in different markets, depending on the month. Clearly, retail sales are up slightly, driven by online sales; both delivered to the home and picked up at a brick-and-mortar location. During COVID, consumers were forced to learn how to cook, and they brought more products home and cooked as a family as a reaction to inflation. Trump's on-again, off-again tariffs continue to baffle everyone, the economy continues to be OK, and Inflation is trending at a 2.9% rate.

Dan Emery has 25 years experience in the food industry, including 15 as vice president of marketing at Pilgrim's Pride. He is directing Meaningful Solutions, a company founded to assist clients in solving problems.

Sources

World Agricultural Supply and Demand Estimates report, issued by the US Department of Agriculture

ConsumerWise research

The Food Institute,

National Restaurant Association

CattleFax

Drovers

Opening photo credit: Getty Images / grafvision / Getty Images Plus